UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | Filed by a Party other than the Registrant |

Check the appropriate box:

| Preliminary Proxy Statement | |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | |

| Definitive Additional Materials | |

| Soliciting Material Pursuant to §240.14a-12 |

Stereotaxis, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| No fee required. | |

| ☐ | Fee paid previously with preliminary materials. |

| Fee computed on table |

STEREOTAXIS, INC.

710 North Tucker Boulevard

Suite 110

St. Louis, Missouri 63101

(314) 678-6100

April 4, 2024

Dear Shareholder:

You are cordially invited to attend our Annual Meeting of Shareholders on Thursday,Wednesday, May 20, 202115, 2024, at 10:00 a.m. (Central Daylight Time) at our Company headquarters at 4320 Forest Park Avenue710 North Tucker Boulevard, Suite 110, in St. Louis, Missouri.Missouri 63101.

Details about the meeting are described in the Notice of Internet Availability of Proxy Materials you received in the mail and in this proxy statement. We have also made a copy of our 20202023 Annual Report on Form 10-K and this proxy statement available on the Internet. Whether or not you plan to attend the meeting, we encourage you to read our 20202023 Annual Report and this proxy statement and to vote your shares.

Because of the current COVID-19 pandemic it is possible that the date, time, or location of the annual meeting will change. In the event circumstances dictate a change, the Company will comply with Delaware law and also SEC rules and guidance.

Your vote is very important to us. Most shareholders hold their shares in street name through a broker and may vote by using the Internet, by telephone or by mail. If your shares are held in the name of a bank, broker, or other holder of record, you must present proof of your ownership, such as a bank or brokerage account statement, to be admitted to the meeting and if you plan to vote your shares in person at the meeting, you must obtain a proxy, executed in your favor, from your bank or broker. All shareholders must also present a form of personal identification in order to be admitted to the meeting.

On behalf of the entire Board, I thank you for your continued support and look forward to seeing you at the meeting.

| Sincerely, | |

| /s/ David L. Fischel | |

| David L. Fischel | |

| Chief Executive Officer and | |

| Chairman of the Board |

STEREOTAXIS, INC.

710 North Tucker Boulevard

Suite 110

St. Louis, Missouri 63101

(314) 678-6100

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

April 9, 20214, 2024

The Annual Meeting of Shareholders of Stereotaxis, Inc. will be held at our principal executive offices located at 4320 Forest Park Avenue,710 North Tucker Boulevard, Suite 100,110; St. Louis, Missouri 63108,63101, on Thursday,Wednesday, May 20, 202115, 2024, at 10:00 a.m. (Central Daylight Time) for the following purposes:

| 1. | To elect | |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year | |

| 3. | To approve an amendment to the Stereotaxis, Inc. | |

| 4. | To approve an amendment to the 2022 Employee Stock Purchase Plan (“ESPP”) to increase the number of shares of common stock authorized for issuance | |

| 5. | To transact such other business as may properly come before the meeting. |

The Board of Directors fixed Monday, March 22, 202118, 2024, as the date of record for the meeting, and only shareholders of record at the close of business on that date will be entitled to vote at the meeting or any adjournment thereof.

We began sending to all shareholders of record a Notice of Internet Availability of Proxy Materials on April 9, 2021.4, 2024. Please note that our Annual Report on Form 10-K for the fiscal year ended December 31, 20202023, is available for viewing on the Internet. Please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail.

By Order of the Board of Directors,

| |

| STEREOTAXIS, INC. | |

| /s/ | |

Laura Spencer Garth | |

| Secretary | |

| St. Louis, Missouri | |

| April |

IMPORTANT NOTICE

Please Vote Your Shares Promptly

TABLE OF CONTENTS

| 3 |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

| Q. | Why am I receiving these materials? |

The Board of Directors (the “Board”) of Stereotaxis, Inc. (the “Company”) is soliciting proxies from the Company’s shareholders in connection with its 20212024 Annual Meeting of Shareholders to be held on May 20, 202115, 2024, and any and all adjournments and postponements thereof. You are encouraged to vote on the proposals presented in these proxy materials. You are invited to attend the Annual Meeting, but you do not have to attend to vote.

| Q. | When and where is the Annual Meeting? |

We presently intend to hold the Annual Meeting of Shareholders on Thursday,Wednesday, May 20, 202115, 2024, at 10:00 a.m. Central Daylight Time, at our principal executive offices located at 4320 Forest Park Avenue,710 North Tucker Boulevard, Suite 100,110, St. Louis, Missouri 63108.MO 63101.

Because of the current COVID-19 pandemic it is possible that the date, time, or location of the annual meeting will change. In the event circumstances dictate a change, the Company will comply with Delaware law and also SEC rules and guidance.

| Q. | Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? |

In accordance with rules adopted by the Securities and Exchange Commission (the “SEC”), we may furnish proxy materials, including this proxy statement and our 20202023 Annual Report on Form 10-K, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice, which was mailed to most of our shareholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

| Q. | How do I get electronic access to the proxy materials? |

The Notice will provide you with instructions regarding how to view our proxy materials for the Annual Meeting on the Internet.

| Q. | Who is entitled to vote? |

You are entitled to vote if you were a shareholder of record of shares of our common stock or Series A Convertible Preferred Stock at the close of business on Monday, March 22, 202118, 2024 (the “Record Date”).

On March 22, 2021,18, 2024, there were 74,080,47982,128,762 shares of our common stock and 22,40821,908 shares of our Series A Convertible Preferred Stock outstanding and entitled to vote, subject to specified beneficial ownership limitations in the case of the Series A Convertible Preferred Stock. Holders of our Series B Convertible Preferred Stock are not entitled to vote on any matter being presented for consideration at the Annual Meeting.

| Q. | How many votes do I have? |

Each share of common stock that you own entitles you to one vote. On the Record Date, there were a total of 74,080,479,82,128,762 shares of common stock outstanding. As of the Record Date, each share of our Series A Convertible Preferred Stock is convertible into 1,9522,228 shares of our common stock and is entitled to one vote for each share of common stock into which it is convertible, subject to specified beneficial ownership limitations. On the Record Date there were 22,40821,908 shares of Series A Convertible Preferred Stock outstanding, entitling the holders of those shares to an aggregate of 14,680,24322,094,988 votes. Accordingly, on the Record Date, the holders of our common stock and Series A Convertible Preferred Stock are entitled to an aggregate of 88,760,722104,223,750 votes in respect of such shares of stock.

| 4 |

| Q. | What am I being asked to vote on? |

We are asking our shareholders to (1) elect twoone Class II directorsdirector to serve until the 20242027 Annual Meeting and until, at the election of the Company, their respective successors arehis successor is duly elected and qualified,qualified; (2) ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 20212024 fiscal year,year; (3) approve an amendment to the Stereotaxis, Inc. 20122022 Stock Incentive Plan (“2022 Stock Incentive Plan”) increase the number of shares of common stock authorized for issuance thereunder by 4,000,000 shares (“2022 Stock Incentive Plan Amendment”); (4) approve an amendment to the Employee Stock Purchase Plan (“ESPP”) to increase the number of shares of common stock authorized for issuance thereunder by 4,000,000 shares; (4) approve the issuance of up to 13,000,000250,000 shares under the 2021 CEO Performance Share Unit Award;(“ESPP Amendment”); and (5) transact such other business as may properly come before the meeting.

| Q. | What do I do if my shares of common stock are held in “street name” at a bank or brokerage firm? |

If your shares are held in an account at a brokerage firm, bank, broker-dealer, trust or other similar organization, like the vast majority of our shareholders, you are considered the beneficial owner of shares held in “street name”, and the Notice was forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee, or nominee how to vote your shares, and you are invited to attend the Annual Meeting.

| Q. | How do I vote? |

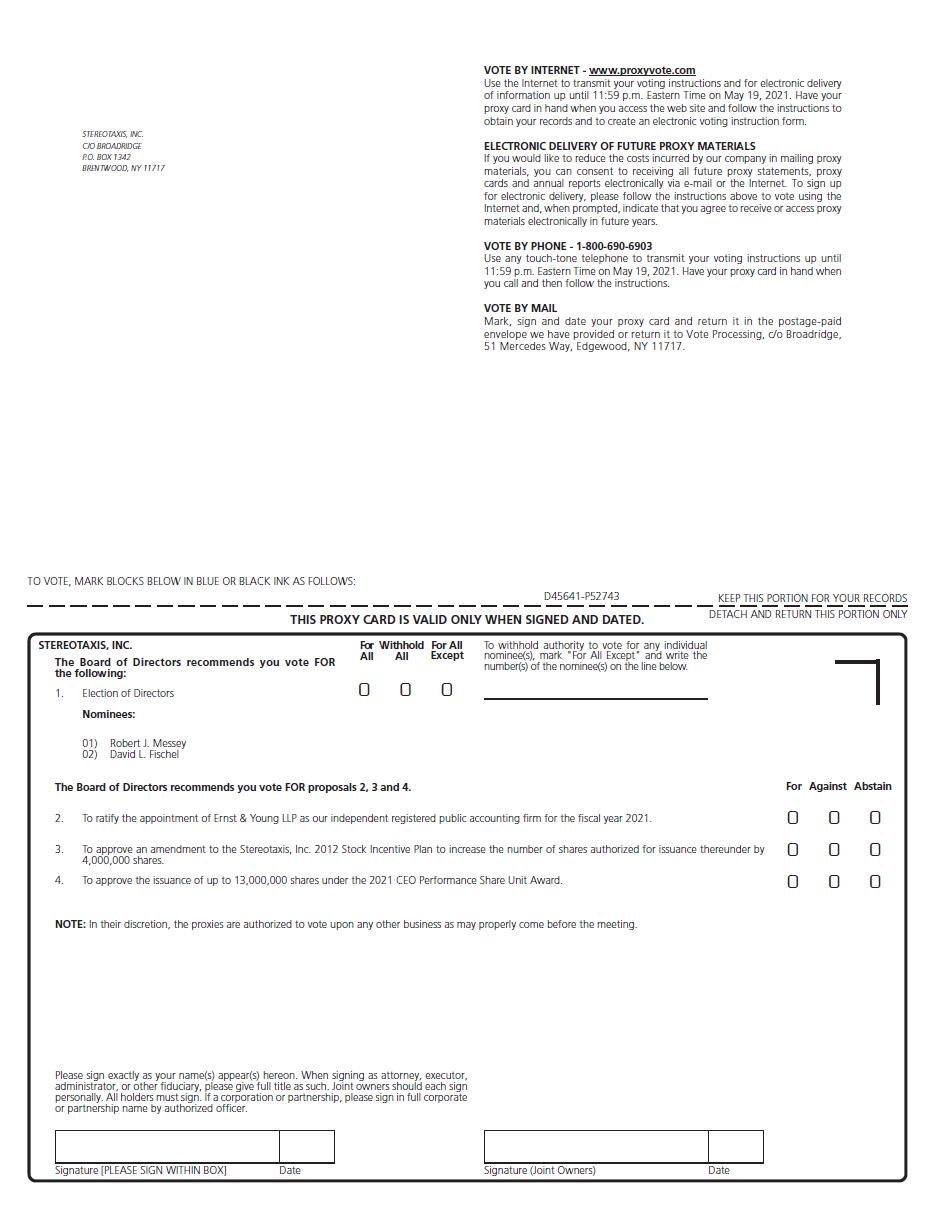

Whether or not you expect to be present in person at the Annual Meeting, you are requested to vote your shares. Most shareholders will be able to choose whether they wish to vote using the Internet, by telephone or by mail. The availability of Internet voting or telephone voting for shareholders whose shares are held in “street name” by a bank or a broker may depend on the voting processes of that organization. If you vote using the Internet, you may incur costs such as telephone and Internet access charges for which you will be responsible. Internet and telephone voting facilities will be available 24 hours a day and will close at 11:59 p.m., Eastern Daylight Time, on May 19, 2021,14, 2024, the day before the date of the Annual Meeting. If you hold your shares directly as a shareholder of record and you attend the meeting, you may vote by ballot. If you hold your shares in street name through a bank or broker and you wish to vote at the meeting, you must obtain a proxy, executed in your favor, from your bank or broker.

Whether you hold shares directly as the shareholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a shareholder of record, you may vote by proxy. You can vote by proxy over the Internet by following the instructions provided in the Notice or if you requested to receive printed proxy materials, you can also vote by mail, telephone, or the Internet pursuant to instructions provided on the proxy card. If you hold shares beneficially in street name, you may vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by following the voting instruction card provided to you by your broker, bank, trustee, or nominee.

| Q. | What if I want to change my vote? |

If you are a shareholder of record, you can revoke your proxy at any time before it is voted at the Annual Meeting by:

| ● | timely delivering a properly executed, later-dated proxy; | |

| ● | submitting a later vote by Internet or telephone any time prior to 11:59 p.m., Eastern Daylight Time, on May | |

| ● | delivering a written revocation of your proxy to our Secretary at our principal executive offices; or | |

| ● | voting by ballot at the meeting. |

If your shares are held in the name of a bank or brokerage firm, you may change your vote by submitting new voting instructions to your bank or broker following the instructions that they provide.

| 5 |

| Q. | What vote of the shareholders is needed? |

No business can be conducted at the Annual Meeting unless a majority of the outstanding shares of common stock entitled to vote is present in person or represented by proxy at the meeting. Each share of our common stock is entitled to one vote with respect to each matter on which it is entitled to vote. Each share of Series A Convertible Preferred Stock is entitled to one vote on an as-converted basis, subject to specified beneficial ownership limitations applicable to the holders of the Series A Convertible Preferred Stock. As noted above, holders of our Series B Convertible Preferred Stock are not entitled to vote on any matter being presented for consideration at the Annual Meeting. A plurality of the shares entitled to vote and present in person or by proxy at the meeting must be voted “FOR” a director nominee. A majority of shares entitled to vote and present in person or by proxy at the meeting must be voted “FOR” the ratification of Ernst & Young LLP as our independent registered public accounting firm for the 20212024 fiscal year, “FOR” for the amendment to our 2012 Stock Incentive Plan Amendment to provide that an additional 4,000,000 shares of common stock of the Company be made available for issuance under the Stock Incentive Plan for awards to participants, and “FOR” the issuanceESPP Amendment to provide that an additional 250,000 shares of up to 13,000,000 sharescommon stock of the Company be made available for issuance under the 2021 CEO Performance Share Unit Award.ESPP for awards to participants.

| Q. | What happens if I request a paper copy of proxy material and return my signed proxy card but forget to indicate how I want my shares of common stock voted? |

If you sign, date and return your proxy and do not mark how you want to vote, your proxy will be counted as a vote “FOR” all of the nominees for directors, “FOR” the ratification of our independent registered public accounting firm, “FOR” the amendment to our 2012approval of the 2022 Stock Incentive Plan Amendment to increase the number of shares of common stock authorized for issuance under the Stock Incentive Plan by 4,000,000 shares, “FOR” the issuanceapproval of upthe ESPP Amendment to 13,000,000increase the number of shares of common stock authorized for issuance under the 2021 CEO Performance Share Unit Award,ESPP by 250,000 shares, and in the discretion of the proxy holders for such other business as may properly come before the meeting.

| Q. | What happens if I do not instruct my broker how to vote or if I indicate I wish to “abstain” on the proxy? |

If you hold shares in street name through a broker or other nominee and do not vote your shares or provide voting instructions, your broker may vote for you on “routine” proposals but not on “non-routine” proposals. Rules of the New York Stock Exchange (“NYSE”) determine whether proposals are routine or non-routine. Therefore, if you do not vote on the non-routine proposals or provide voting instructions, your broker will not be allowed to vote your shares on these matters. This will result in a “broker non-vote”. Broker non-votes are not counted as shares present and entitled to vote so they will not affect the outcome of the vote.

We expect that the following proposal will be considered “routine” under applicable NYSE rules: Proposal 2 (the ratification of Ernst & Young LLP as the Company’s independent registered public accountants.accountants). Accordingly, if you do not provide voting instructions to your broker, we expect that your broker will be permitted to vote your shares on this proposal, but all of our other proposals are “non-routine”. Therefore, if you do not vote on the non-routine proposals or provide voting instructions, your broker will not be allowed to vote your shares. This will result in a broker non-vote. Broker non-votes are not counted as shares present and entitled to vote so they will not affect the outcome of the vote.

If you indicate that you wish to “abstain,” your vote will have the same effect as a vote against the proposal or the election of the applicable director.

| Q. | What if other matters are voted on at the Annual Meeting? |

If any other matters are properly presented for consideration at the Annual Meeting and you have voted your shares by Internet, telephone or mail, the persons named as proxies in your proxy will have the discretion to vote on those matters for you. As of the date we filed this proxy statement with the Securities and Exchange Commission, the Board of Directors did not know of any other matter to be presented at the Annual Meeting.

| Q. | What do I need to do if I plan to attend the meeting in person? |

All shareholders must present a form of personal identification in order to be admitted to the meeting. If your shares are held in the name of a bank, broker, or other holder of record, you also must present proof of your ownership, such as a bank or brokerage account statement, to be admitted to the meeting.

INFORMATION ABOUT THE BOARD OF DIRECTORS

The number of directors set by the Board is nine. Currently,The directors are distributed among three staggered classes (Classes I, II and III), of three directors each. At each annual meeting of shareholders, a class of directors is elected for a term of three years to succeed the class of directors whose terms are then expiring. The terms of the Class I, II and III Directors will expire upon the election and qualification of successor directors at the annual meeting of shareholders to be held this year for the Class II Directors, in 2025 for the Class III Directors, and in 2026 for the Class I Directors, or upon their earlier death, resignation or removal.

David L. Fischel, who was appointed to the Board as a Class II Director in September 2016 and who became our Chief Executive Officer in February 2017, is a nominee as a Class II Director at the 2024 Annual Meeting for reelection to a three-year term expiring in 2027. Following a request by current Class II director Robert J. Messey to not be renominated for election to the Board, the Board has determined not to renominate Mr. Messey. Mr. Messey’s request to not be renominated is not a result of any disagreements with the Company. In addition, there are currently two vacancies on the Board, one vacancy in Class I and one vacancy in Class III. Our Class II directors have terms that expire at the 2021 Annual Meeting. One of the current Class II directors, Joe Kiani, has advised the Board that he is retiring from the Board due to his schedule and is not standing for reelection. After giving effect to Mr. Kiani’s retirement, following the 2021 Annual Meeting there will be one vacancy in Class I, one vacancy in Class II and one vacancy in Class III. Under the terms of our restated certificate of incorporation and bylaws, the boardBoard of directorsDirectors may fill these vacancies at any time. The Board will make a determination in the coming months to fill the vacancy resulting from the conclusion of Mr. Messey’s term with a new qualified director.

Set forth below is the name, age, and business experience of each of the continuing directors and nominees of the Company, including the specific experience, qualifications, attributes, or skills that led to the conclusion that such person should serve as a director. Dr. Nathan Fischel is the father of David L. Fischel, our Chief Executive Officer and Chairman of the Board.

Class II Directors (NomineesDirector

(Nominee for election to the Board at the 20212024 Annual Meeting to serve a three-year term until the 20242027 Annual Meeting)

David L. Fischel

Chief Executive Officer and Chairman of the Board since February 2017

Director since September 2016

Mr. Fischel, 34,37, has served as Chief Executive OfficerChairman and Chairman of the Board since February 2017. He has served as a directorCEO of Stereotaxis since 2017, leading the equity investmentCompany’s efforts to return to financial health, drive commercial growth, and positive strategic initiatives announced in September 2016.advance a comprehensive innovation strategy. He has served for over ten years as Principal and portfolio manager for medical device investments at DAFNA Capital Management, LLC. Prior to joining DAFNA Capital, he was a research analyst at SCP Vitalife, a healthcare venture capital fund. Mr. Fischel completed his B.S. magna cum laude in Applied Mathematics with a minor in Accounting at the University of California at Los Angeles and received his MBA from Bar-Ilan University in Tel Aviv. He is a Certified Public Accountant, Chartered Financial Analyst and Chartered Alternative Investment Analyst. Mr. Fischel’s extensive understanding of our business, operations and strategy, as well as financial and medical device industry experience, enable him to make valuable contributions to the Board of Directors.

Robert J. Messey

Director since May 2005

Mr. Messey, 75, served as the senior vice president and chief financial officer of Arch Coal, Inc. from December 2000 until his retirement in April 2008. Prior to joining Arch Coal, he served as the vice president of financial services of Jacobs Engineering Group, Inc. from 1999 to 2000 following that company’s acquisition of Sverdrup Corporation, where he served as senior vice president and chief financial officer from 1992 to 1999. Mr. Messey was an audit partner at Ernst & Young LLP from 1981 to 1992. He previously served as a director and member of the audit and compensation committees of Oxford Resource Partners, LP, a publicly traded coal mining company, from May 2010 to December 2014, and as a director and chairman of the audit committee of Baldor Electric Company, a publicly traded manufacturer of industrial electrical motors, from May 1993 to January 2011. He serves as an advisory director, chairman of the compensation committee, and member of the audit committee of a privately held conglomerate. Mr. Messey earned his B.S.B.A. from Washington University. Mr. Messey’s experience in finance and accounting provides the Board with a great deal of expertise on financing, accounting and compliance matters.

Class III Directors (terms expiring at the 20222025 Annual Meeting)

Nathan Fischel, M.D.

Director since February 2017

Dr. Fischel, 65,68, is the Founder and CEO of DAFNA Capital Management, LLC. DAFNA Capital is an SEC registered investment advisor with a highly successful investment track record of over 2225 years focused on innovations in biotechnology and medical devices. Dr. Fischel was Professor of Pediatrics at UCLA School of Medicine and attending physician in Pediatric Hematology and Oncology at Cedars-Sinai Medical Center in Los Angeles. He has published over 120 peer-reviewed scientific and medical manuscripts and book chapters, has been the principal investigator of multiple National Institutes of Health (“NIH”) funded research grants, has served repeatedly on internal and external review panels at the NIH, and was appointed by the U.S. Secretary of Health and Human Services to serve for four years on the Advisory Council of one of the NIH’s institutes. Dr. Fischel received his M.D. from the Technion Israel Institute of Technology and served his internship year at Hadassah Hospital in Jerusalem. He completed his residency and fellowship in Pediatrics and Pediatric Hematology and Oncology at the Children’s Hospital and the Dana-Farber Cancer Institute, Harvard Medical School in Boston, and his postgraduate research training in Molecular Genetics at Oxford University in England. Dr. Fischel’s experience as a physician enables him to provide critical perspectives regarding our technologies and commercial adoption of our products, and his extensive knowledge of medical device companies allows him to provide insight to the Board on strategic decisions.

| 7 |

Ross B. Levin

Director since July 2018

Mr. Levin, 37,40, is the Director of Research for Arbiter Partners Capital Management LLC and a principal in the firm. Mr. Levin serves on the boards of directors of Capital Senior Living Corporation and Stereotaxis Inc. and is a former board member of Capital Senior Living Corporation, Mood Media Corporation, American Community Properties Trust and Presidential Life Corporation. Mr. Levin is also chairman of the board of directors of Constructive Partnerships Unlimited, a nonprofitnon-profit organization providing services and programs for people with developmental disabilities, and former vice chairman of the board of the Cerebral Palsy Associations of New York State. Mr. Levin is a member of the New York Society of Securities Analysts and a CFA charter holder. Mr. Levin holds a Bachelor of Science degree in Management with a concentration in Finance from the A.B. Freeman School of Business at Tulane University and has completed the Investment Decisions and Behavioral Finance program at the John F. Kennedy School of Government at Harvard University.

Class I Directors (terms expiring at the 20232026 Annual Meeting)

David W. Benfer

Director since February 2005

Mr. Benfer, 74,77, has served as the chairman of The Benfer Group LLC, which provides advisory services to healthcare providers and suppliers, since 2010. From 1999 to 2009, Mr. Benfer served as president and chief executive officer of Saint Raphael Healthcare System and the Hospital of Saint Raphael, New Haven, Connecticut. Prior to that, he was the president and chief executive officer of the Provena-Saint Joseph/Morris Health Network in Joliet, Illinois from 1992 to 1999. Mr. Benfer served as senior vice president for Hospital and Urban Affairs for the Henry Ford Health System in Detroit and chief executive officer of the Henry Ford Hospital from 1985 to 1992. He served as the chairman of the American College of Healthcare Executives (ACHE) from 1998 to 1999 and on its board of governors from 1992 to 2000. Mr. Benfer was named a Fellow of ACHE in 1981 and served on the board of the Catholic Health Association from 2003 until 2008. He earned his M.B.A. from Xavier University and his B.S.B.A. from Wittenburg University. Mr. Benfer’s extensive experience in the healthcare industry and in hospital management provides the Company with useful industry information related to technology acquisition, governance, and risk and liability issues. Mr. Benfer serves on the Board of The John and Mable Ringling Museum of Art Foundation, Inc., the state museum of Florida.

Arun S. Menawat, Ph.D.

Director since September 2016

Dr. Menawat, 66,69, is Chairman and CEO of Profound Medical Corp. (NASDAQ:PROF) (TXSV:PRN), a medical device company that is driving commercialization of real-time MRI-guided ablation for prostate diseases including cancer. Dr. Menawat has an accomplished history of executive leadership success in the healthcare industry. He was previously the Chairman, President, and CEO of Novadaq Technologies Inc. (NASDAQ:NVDQ) (TXS:NDQ). Under his 13-year tenure at Novadaq, he transformed the company from a small private pre-commercial company into the leader in intraoperative imaging and was instrumental in signing strategic partnerships with companies including Intuitive Surgical, LifeCell, and KCI. He obtained a Ph.D. in Chemical (Bio) Engineering from the University of Maryland, while concurrently completing a fellowship in biomedical engineering at the U.S. National Institute of Health and holds an Executive MBA from the J.L. Kellogg School of Management, Northwestern University. In 2014, Dr. Menawat was named the EY Ontario Entrepreneur of the Year in the health sciences category. Dr. Menawat’s strong executive experience with medical device companies provides the Board with valuable guidance for product innovation, customer initiatives and operational matters.

| 8 |

Myriam Curet, M.D.

Director since July 2021

Dr. Curet, 67, currently serves as Executive Vice President and Chief Medical Officer for Intuitive Surgical, the global leader and pioneer of robotic surgery. Dr. Curet joined Intuitive Surgical in 2005 and has since led the development of clinical evidence, physician education, and reimbursement activities that have been instrumental to Intuitive Surgical’s growth across multiple clinical specialties. For more than 20 years, Dr. Curet has also served as a Clinical Professor of Surgery at Stanford University School of Medicine, with a part-time clinical appointment at the Palo Alto Veteran’s Administration Medical Center. Dr. Curet received her M.D. from Harvard Medical School and completed her general surgery residency at the University of Chicago. Dr. Curet’s extensive medical credentials and her executive experience in a medical device company provide the Board with significant insights on the commercial adoption of our products, as well as product innovation and operational matters.

CORPORATE GOVERNANCE INFORMATION

Board Leadership Structure and Board Role in Risk Oversight

David L. Fischel became chief executive officer and chairman of the board effective February 3, 2017. Since February 2015, David W. Benfer has served as the lead independent director. The Board believes that it should have flexibility to make the determination of whether the same person should serve as both the chief executive officer and chairman of the board or if the roles should be separate. The Board believes that its current leadership structure, with the positions of chief executive officer and chairman of the Board held by the same individual and Mr. Benfer serving as lead independent director, provides appropriate leadership for the Company and best serves the shareholders. Mr. Benfer provides independent leadership on the Board and interacts with the chief executive officer and the other independent directors to facilitate communications. Our independent directors regularly have executive sessions as part of our regular meeting schedule, during which only the independent directors are present. Mr. Benfer leads these sessions and provides feedback to the chief executive officer.officer and, when appropriate, other senior management.

Our Board provides risk oversight to the Company through the Audit Committee. The Audit Committee monitors financial, healthcare compliance, and regulatory risks. This oversight process takes place through discussions at committee meetings with the members of senior management who are responsible for the Company’s risk management policies and procedures. In addition, the Audit Committee regularly meets in a private session with the Company’s independent auditors.

Director Independence

Our common stock is listed on The New York Stock Exchangethe NYSE American Exchange (“NYSE American”) under the trading symbol “STXS”. The stock began trading on the NYSE American on September 6, 2019. Prior to that date the stock had traded on the OTCQX® Best Market since August 4, 2016. Historically, ourOur Board has considered the independence of our directors under the listing standards of The NASDAQ Capital Market. With the uplisting to the NYSE American in 2019 our Board now is required to evaluate and affirmatively determine the independence of our directors under the listing standards of the NYSE American, specifically, NYSE American Company Guide Section 803.

With the exception of David L. Fischel and Dr. Nathan Fischel, our Board determined that each member of the Board and the respective Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee were independent in 20202023 under the listing standards of the NYSE American.

| 9 |

Director Nomination Process

The Nominating and Corporate Governance Committee is responsible for identifying and recommending to the Board candidates to serve as members of the Board. In carrying out this responsibility, the committee has adopted a written policy setting forth the minimum qualifications to serve as a director of the Company. These minimum qualifications emphasize integrity, independence, experiences,experience, strength of character, mature judgment, and technical skills applicable to the Company. The committee will also consider whether the candidate is able to represent all shareholders of the Company fairly and equally, without favoring or advancing any particular shareholder or other constituency of the Company.

The committee also seeks Board members from diverse professional backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. Directors should have experience in positions with a high degree of responsibility, be leaders in the companies or institutions with which they are affiliated, and/or be selected based upon contributions they can make to the Company and Board. We do not have a formal policy regarding diversity, but the Board is committed to a diverse membership. In selecting nominees, the Board does not discriminate on the basis of race, color, national origin, sex (including pregnancy, sexual orientation, gender, and/or gender identity), religion, disability, or sexual orientation.age.

The committee may approve, in its discretion, the candidacy of a nominee who does not satisfy all of these requirements if it believes the service of the nominee is in the best interests of the Company and its shareholders.

The committee has written procedures for identifying and evaluating candidates for election to the Board. The material elements of that process are as follows:

| ● | The committee gives due consideration to the re-nomination of incumbent directors who desire to continue their service and who continue to satisfy the committee’s criteria for membership on the Board. | |

| ● | If there is no qualified and available incumbent or if there is a vacancy on the Board, the committee will identify and evaluate new candidates and will solicit or entertain recommendations for nominees from other Board members and the Company’s management. The committee also may engage a professional search firm to assist it in identifying qualified candidates. |

Nomination of Directors by Shareholders

The Nominating and Corporate Governance Committee will evaluate candidates proposed by shareholders for nomination as directors under criteria similar to the evaluation of other candidates. Our bylaws provide that shareholders seeking to nominate candidates for election as directors at an annual meeting of shareholders must provide timely notice in writing. To be timely, a shareholder’s notice must be delivered to or mailed and received at our principal executive offices not more than 120 days or less than 90 days prior to the anniversary date of the immediately preceding annual meeting of shareholders. However, in the event that the annual meeting is called for a date that is not within 30 days before or after such anniversary date, notice must be received not later than the close of business on the 10th day following the date on which notice of the date of the annual meeting was mailed to shareholders or made public, whichever occurs first. Our bylaws specify requirements as to the form and content of a shareholder’s notice. These provisions may preclude shareholders from making nominations for directors at an annual meeting of shareholders.

| 10 |

The Nominating and Corporate Governance Committee has established a written policy that it will consider recommendations for the nomination of a candidate submitted by holders of the Company’s shares entitled to vote generally in the election of directors. The material elements of that policy include the following:

| ● | The committee will give consideration to these recommendations for positions on the Board where the committee has determined not to re-nominate a qualified incumbent director; | |

| ● | For each annual meeting of shareholders, it is anticipated that the committee will accept for consideration only one recommendation from any shareholder or affiliated group of shareholders (within the meaning of SEC Regulation 13D); and | |

| ● | While the committee has not established a minimum number of shares that a shareholder must own in order to present a nominating recommendation for consideration, or a minimum length of time during which the shareholder must own its shares, the committee may, in its discretion, take into account the size and duration of a recommending shareholder’s ownership interest in the Company. |

The committee may, in its discretion, also consider the extent to which the shareholder making the nominating recommendation intends to maintain its ownership interest in the Company; to the extent such information is available to the committee. The committee may elect not to consider recommendations of nominees who do not satisfy the criteria described above, including that a director must represent the interests of all shareholders and not serve for the purpose of favoring or advancing the interests of any particular shareholder group or other constituency. Absent special or unusual circumstances, only those recommendations whose submission complies with the procedural requirements adopted by the committee will be considered by the committee.

Any shareholder wishing to submit a candidate for consideration should send the following information to the corporate secretary,Corporate Secretary, Stereotaxis, Inc., 4320 Forest Park Avenue,710 North Tucker Boulevard, Suite 100,110, St. Louis, Missouri 63108:63101.

| ● | Shareholder’s name, number of shares owned, length of period held and proof of ownership; | |

| ● | Name, age, business, and residential address of candidate; | |

| ● | A detailed résumé describing, among other things, the candidate’s educational background, occupation, employment history and material outside commitments (e.g., memberships on other boards and committees, charitable foundations); | |

| ● | A supporting statement which describes the candidate’s reasons for seeking election to the Board and documents his/her ability to satisfy the director qualifications described herein; | |

| ● | Any information relating to the candidate that is required to be disclosed in the solicitation of proxies for election of director; | |

| ● | The class and number of shares of our capital stock that are beneficially owned by the candidate; | |

| ● | A description of any arrangements or understandings between the shareholder and the candidate; and | |

| ● | A signed statement from the candidate, confirming his/her willingness to serve on the Board. |

Our corporate secretaryCorporate Secretary will promptly forward such materials to the chair of our Nominating and Corporate Governance Committee and our chairman of the Board. Our corporate secretaryCorporate Secretary will also maintain copies of such materials for future reference by the committee when filling Board positions. Shareholders may submit potential director candidates at any time pursuant to these procedures.

Shareholder Communications Policy

Any shareholder wishing to send communications to our Board should send the written communication and the following information to our Corporate Secretary, Stereotaxis, Inc., 4320 Forest Park Avenue,710 North Tucker Boulevard, Suite 100,110, St. Louis, Missouri 63108:63101:

| ● | Shareholder’s name, number of shares owned, length of period held and proof of ownership; | |

| ● | Name, age, business, and residential address of shareholder; and | |

| ● | Any individual director or committee to whom the shareholder would like to have the written statement and other information sent. |

The corporate secretaryCorporate Secretary will forward the information to the chairman of the Board, if addressed to the full Board, or to the specific director to which the communication is addressed.

| 11 |

Code of Conduct

Our Board has adopted a Code of Conduct that applies to all of our directors, officers, and employees. Shareholders may download a free copy of our Code of Conduct from our website (www.stereotaxis.com) or by written request to our Chief Compliance Officer as follows:

Matthew Stepanek, Sr. Director, Regulatory Affairs

Stereotaxis, Inc.

4320 Forest Park Avenue,710 North Tucker Boulevard, Suite 100110

St. Louis, Missouri 6310863101

We intend to promptly disclose any amendments to, or waivers from, any provision of the Code of Conduct by posting the relevant material on our website (www.stereotaxis.com) in accordance with SEC rules.

BOARD MEETINGS AND COMMITTEES

Board Meetings

During fiscal year 2020,2023, the Board of Directors held five meetings and acted one time by unanimous written consent.5 meetings. During fiscal year 20202023 all incumbent directors except Mr. Kiani, attended 75% or more100% of the aggregate meetings of the Board and the Board committees on which they served during the period they held office. Due to his schedule, Mr. Kiani attended less than 75% or more of the Board’s meetings. Directors are encouraged, but not required, to attend our Annual Meeting of Shareholders. Mr. David Benfer, Mr. David Fischel and Mr. Robert Messey did attendattended our 20202023 Annual Meeting of Shareholders.

Board Committee Membership

The Board has established three standing committees. Presently, the standing committees are: Audit, Compensation, and Nominating and Corporate Governance. Committee membership as of the end of fiscal year 20202023 was as follows:

| Audit | Compensation | |

| Ross B. Levin, Chairman | Arun Menawat, Chairman | |

| David W. Benfer | Myriam Curet | |

| Robert J. Messey | ||

| David W. Benfer |

| Nominating & Corporate Governance | ||

| David W. Benfer, Chairman | ||

| Myriam Curet | ||

| Ross B. Levin | ||

Effective February 2021, Mr. Benfer joined the Compensation Committee.

The Board has adopted a written charter for each of the committees. The charters of our Audit, Compensation, and Nominating and Corporate Governance Committees, and our Code of Conduct are published on our website at www.stereotaxis.com, Investors, Board & Management.Management, Governance. These materials are available in print to any shareholder upon request. From time to time, the Board and the committees review and update these documents, as they deem necessary and appropriate.

As noted previously, the Board has determined not to renominate Mr. Messey for re-election to the Board at the 2024 Annual Meeting. The Board anticipates appointing Dr. Arun Menawat as a member of the Audit Committee prior to the 2024 Annual Meeting. The Board anticipates a determination that Dr. Arun Menawat is independent under the listing standards of the NYSE American and the enhanced independence standards for audit committee members set forth in SEC rules under the Securities Exchange Act of 1934, and is financially sophisticated.

| 12 |

Audit Committee

The Board has determined that each member of the Audit Committee is independent under the listing standards of the NYSE American and the enhanced independence standards for audit committee members set forth in SEC rules under the Securities Exchange Act of 1934. Further, our Board has determined that each member of the Audit Committee is financially sophisticated andsophisticated. At all times since his service on the Board since May 2005, the Board had determined that Mr. Messey who currently serves as the chair of the Audit Committee, qualifies as an Audit Committee Financial Expert“audit committee financial expert” under SEC rules and regulations. Prior to the Annual Meeting, the Board plans to determine whether Mr. Levin also qualifies as an audit committee financial expert under SEC rules and regulations based upon his extensive financial and accounting experience. The Audit Committee assists our Board in its oversight of:

| ● | the integrity of our financial statements; | |

| ● | our accounting and financial reporting process, including our internal controls; | |

| ● | our compliance with legal and regulatory requirements; | |

| ● | the independent registered public accountants’ qualifications and independence; and | |

| ● | the performance of our independent registered public accountants. |

The Audit Committee has direct responsibility for the appointment, compensation, retention, and oversight of our independent registered public accountants. In addition, the Audit Committee must approve in advance:

| ● | any related-party transaction that creates a | |

| ● | all audit services; and | |

| ● | all non-audit services, except for de minimis non-audit services, provided the Audit Committee has approved such de minimis services prior to the completion of the audit. |

During fiscal year 2020,2023, the Audit Committee met fivefour times and acted one timetwo times by unanimous written consent.

Compensation Committee

Our Board has determined that each director serving on the Compensation Committee during 20202023 was independent under the listing standards of the NYSE American, and that each qualified as an “outside director” under Section 162(m) of the Internal Revenue Code of 1986 and as a “non-employee director” under Rule 16b-3 under the Securities Exchange Act of 1934. The functions of the Compensation Committee include:

| ● | assisting management and the Board in defining an executive compensation policy; | |

| ● | determining the total compensation package for our chief executive officer and other executive officers; | |

| ● | performing or, to the extent deemed appropriate delegating to our officers, reviewing and monitoring the administration of our equity-based compensation plans and qualified and non-qualified benefit plans; | |

| ● | approving new incentive plans and major benefit programs; and | |

| ● | approving changes to the outside directors’ compensation program. |

The Compensation Committee has authority to retain compensation consultants to furnish advice or assistance to the committee within the scope of its duties. The committee has direct responsibility for the appointment, retention, and compensation of the compensation consultants as well as the oversight of the work of the consultants. In selecting any compensation consultant, the committee considers the factors relevant to the consultant’s independence from management in accordance with the listing standards of the NYSE American.

During fiscal year 2020,2023, the Compensation Committee met one time and acted three times by unanimous written consent.time.

Nominating and Corporate Governance Committee

Our Board has determined that each director serving on the Nominating and Corporate Governance Committee during 20202023 was independent under the listing standards of the NYSE American. The Nominating and Corporate Governance Committee assists the Board in:

| ● | identifying and evaluating individuals qualified to become Board members; | |

| ● | reviewing director nominees received from shareholders; | |

| ● | selecting director nominees for submission to the shareholders at our annual meeting; | |

| ● | selecting director candidates to fill any vacancies on the Board; and | |

| ● | overseeing the structure and operations of the Board, including recommending Board committee structure, appointments, and responsibilities. |

The Nominating and Corporate Governance Committee is also responsible for developing and recommending to the Board a set of corporate governance guidelines and principles. During fiscal year 2020,2023, the Nominating and Corporate Governance Committee met one time.

| 13 |

Director Compensation Policy

In February 2017,Under the Compensation Committee adopted a newJuly 2021 Non-Employee Director compensation program, for our non-employee directors effective for the 2017 fiscal year. Eacheach director now receives an annual award of 60,000 restricted share units.units (RSUs) equal to $200,000 annually, payable in two-equal semi-annual installments valued at $100,000, each with the number of RSUs issued at each semi-annual installment calculated by dividing (a) the total semi-annual grant value of $100,000 by (b) the adjusted closing per share on the accounting grant date for each semi-annual period. The annual equity awards are made in two equal installments on the first business day of January and the first business day of July in each calendar year, paid in arrears (the first installment is compensation for the six months ending December 31st, and the second installment is compensation for the six months ending June 30th) and pro-rated if applicable (in the event a new director is nominated and elected).

Each director has the option to choose one of two vesting schedules prior to the commencement of the year. Each director may elect either for: (1) the restricted share units to vest immediately with the first option as of the date of the award; or (2) the restricted share units to vest on the earliest to occur of (i) the fifth anniversary of the date of the award, (ii) the date on which the service of the director on the Board of Directors terminates, or (iii) a “change of control” of the Company, as defined in the award agreement.

We reimburse our directors for reasonable out-of-pocket expenses incurred in connection with attendance and participation in Board and committee meetings (including costs of travel, food and lodging). Reimbursements for any non-employee director did not exceed the $10,000 threshold in fiscal 20202023 and thus are not included in the table below for director compensation.

Compensation of Directors

The following table discloses compensation to our non-employee directors for their services during 2020:2023:

| Director | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Option Awards ($) | All Other Compensation | Total ($) | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Option Awards ($) | All Other Compensation | Total ($) | ||||||||||||||||||||||||||||||

| David W. Benfer | - | 286,500 | - | - | 286,500 | - | 200,000 | - | - | 200,000 | ||||||||||||||||||||||||||||||

| Myriam Curet(2) | - | 200,000 | - | - | 200,000 | |||||||||||||||||||||||||||||||||||

| David L. Fischel(3) | - | 260,700 | - | - | 260,700 | - | - | - | - | - | ||||||||||||||||||||||||||||||

| Nathan Fischel, M.D.(4) | - | 286,500 | - | - | 286,500 | - | 200,000 | - | - | 200,000 | ||||||||||||||||||||||||||||||

| Joe Kiani(5) | - | 286,500 | - | - | 286,500 | |||||||||||||||||||||||||||||||||||

| Ross Levin | - | 286,500 | - | - | 286,500 | - | 200,000 | - | - | 200,000 | ||||||||||||||||||||||||||||||

| Dr. Arun S. Menawat | - | 286,500 | - | - | 286,500 | - | 200,000 | - | - | 200,000 | ||||||||||||||||||||||||||||||

| Robert J. Messey | - | 286,500 | - | - | 286,500 | - | 200,000 | - | - | 200,000 | ||||||||||||||||||||||||||||||

| (1) | Amount represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. Includes restricted share units | |

| (2) | ||

| (3) | As a member of the Company’s management, Mr. David Fischel | |

PROPOSAL 1: ELECTION OF DIRECTORS

| 14 |

Under the Company’s bylaws, the number of directors of the Company may be fixed or changed from time to time by resolution of a majority of the Board of Directors, provided the number shall be no less than three and no more than fifteen. Currently, the Board has set the number of directors of the Company at nine. The directors are divided into three classes: Class I, Class II and Class III, each class to be as nearly equal in number as possible. The directors in each class are elected for a term of three years. Currently, there is one vacancy in Class I and one vacancy in Class III.

Shareholders are being asked to elect two (2) Directors, Mr. Messey and Mr. David Fischel as Class II directors, to serve until the 2024 Annual Meeting and until their respective successors are duly elected and qualified.

Mr. Kiani, a Class II director since 2016, is not standing for re-election as the 2021 Annual Meeting. At the February meeting of the Nominating and Corporate Governance Committee, Mr. Kiani described how his current commitments and management responsibilities as CEO of a public company leave limited time available for board responsibilities. The Committee and Mr. Kiani came to a mutual decision that it was in his best interests and the best interests of the Company that he not be re-nominated. He and the Committee members expressed the desire that he continue supporting the Company in an unofficial capacity.

After giving effect to Mr. Kiani’s retirement, following the 2021 Annual Meeting there will be one vacancy in Class I, one vacancy in Class II, and one vacancy in Class III.

The Board does not contemplate that any of the nominees will be unable to stand for election, but should any nominee become unable to serve or for good cause will not serve; all proxies (except proxies marked to the contrary) will be voted for the election of a substitute nominee recommended by our Board.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NAMED NOMINEES AS DIRECTORS.

The following discussion and analysis of the compensation arrangements of our Named Executive Officers for 20202023 is intended to provide additional context about our compensation philosophy and our Board’s compensation-related decisions in 2020.2023. It should be read together with the compensation tables and related disclosures set forth below.

This discussion contains forward-looking statements that are based on our current considerations, expectations, and determinations regarding future compensation programs. The actual amount and form of compensation and the compensation programs that we adopt may differ materially from current or planned programs as summarized in this discussion.

The following discussion and analysis relate to the compensation arrangements for 20202023 of (i) our principal executive officer and (ii) our principal financial officer, who are the two officers included in our Summary Compensation Table (our “Named Executive Officers”).

Executive Compensation Summary and Analysis

The Compensation Committee is tasked with discharging the Board of Directors’ responsibilities related to oversight of the compensation of our directors and officers and ensuring that our executive compensation program meets our corporate objectives. The following is a summary and analysis of the executive compensation policies, programs and practices developed by the Compensation Committee, and a description of the compensation of our Named Executive Officers.

Compensation Philosophy

The objective of our compensation program is to attract, retain and motivate highly qualified executive officers while aligning the interests of these executives with those of shareholders. When designing compensation packages to achieve this objective, the committee is guided by the following principles:

| ● | Align pay and performance: Provide total compensation that is commensurate with stock price performance, the operational and financial success of our business, and the individual performance contributions of executives. | |

| ● | Manage program cost and dilution: Balance other considerations for executive pay programs with their impact on earnings, cash flow and stock dilution. | |

| ● | Provide market competitive pay: Targeted compensation opportunities should generally reflect levels, both in terms of size of pay opportunity and mix of pay elements, observed in the competitive marketplace, as defined by the market median pay levels among companies with which we compete for talent. |

We believe that adhering to these principles will create a total compensation program that supports our aim to deliver long-term shareholder value through business performance. In addition to the above principles, the Compensation Committee exercises its judgment in setting pay levels with respect to individual competencies and experience and the internal compensation equity among Named Executive Officers.

Role and Independence of the Consultant

From time-to-time, when deemed necessary, the Compensation Committee engages the services of an independent compensation consultant to provide the committee with market data and analysis, advice on incentive design practices, and an external perspective on pay trends and legal and regulatory developments. In 2021, the committee retained Compensia Inc., aNo compensation advisory firm (“Compensia”), to review CEO equity compensation and implemented a performance-based stock unit grant to our CEO. See Proposal 4 “CEO PERFORMANCE SHARE UNIT AWARD” for additional details. Compensia reported directlyconsultant provided services to the Compensation Committee and did not provide any other services to us. Previously, in 2016, the committee retained Radford, an Aon Hewitt Company (“Radford”), as its independent compensation consultant. Radford has not provided any services to the Company since. The committee considers both Compensia and Radford to be fully independent and that their work has not raised any conflict of interest.during fiscal 2023.

| 15 |

Role of Executive Officers in Compensation Decisions

For executive officers other than our CEO, the Compensation Committee has historically sought and considered input from our CEO regarding such executive officers’ responsibilities, performance, and compensation. Specifically, our CEO recommends base salary increases bonuses, and equity award levels that are used throughout our compensation plans and advises the Compensation Committee regarding the compensation program’s ability to attract, retain and motivate executive talent. These recommendations reflect compensation levels that our CEO believes are qualitatively commensurate with an executive officer’s individual qualifications, experience, responsibility level, functional role, knowledge, skills, and individual performance, as well as the Company’s performance. Our Compensation Committee considers our CEO’s recommendations but may adjust up or down as it determines in its discretion and approves the specific compensation for all the executive officers. All such compensation determinations by our Compensation Committee are largely discretionary.

Our CEO abstains from voting in sessions of the Board of Directors where the Board of Directors acts on the Compensation Committee’s recommendations regarding his compensation.

Executive Compensation Program

The elements of the compensation program for officers are base salary, equity-based long-term incentive, and benefits.

The elements of the compensation package for our CEO are heavily weighted toward his long-term incentive award made pursuant to the Company’s 2021 CEO Performance Share Unit Award Plan, which was approved by shareholders at our 2021 Annual Meeting (see “2023 Executive Compensation—Long-Term Incentive Compensation” below). We also compensate Mr. Fischel with a very modest base salary. We believe a typical compensation arrangement for a similarly situated public company in the medical device industry would provide Mr. Fischel with a six-figure annual salary and a similar six-figure annual cash-bonus, as well as significant annual stock grants that could have value irrespective of stock price appreciation, and a separation agreement providing a year of salary continuation or other typical termination benefits. Under his employment agreement, Mr. Fischel only receives an annual salary of $60,000. The Company does not intend to pay cash or equity bonuses during his employment, and he is not entitled to any such amounts under his employment agreement. Mr. Fischel’s employment agreement is an “at-will” agreement and does not provide for any salary continuation. While Mr. Fischel could realize substantial value from the 2021 CEO Performance Share Unit Award Plan, he will only do so if the Company and its shareholders benefit. Further, as the majority of Mr. Fischel’s compensation is non-cash based, the Company will be able to allocate its cash resources to further strategic initiatives that improve the underlying value of the Company.

Officers other than the CEO are base salary,also eligible for an annual incentive, equity-based long-term incentive, and benefits.cash incentive. The committee has historically set targeted total compensation at the median of the competitive market. The committee may adjust targeted total compensation, or the mix of total compensation based on other considerations such as business performance, company size and stock dilution. In addition, incentive programs are intended to be designed such that total compensation realized by executives is consistent with performance achievement. The objective of the Company’s long-term incentive program is to directly align compensation outcomes with returns received by shareholders, build equity ownership within the management team, and motivate the sustainable financial performance that supports stock price growth. Long-term incentive awards to the CEO are made pursuant to the Company’s 2021 CEO Performance Share Unit Award Plan. Long-term incentive awards to officers other than the CEO are made pursuant to the Company’s 2022 Stock Incentive Plan, which permits grants of cash awards, stock options, stock appreciation rights and stock awards. Throughout the year, the committee may also approve awards in connection with employee promotions, employee retention, an individual newly hired to the Company, or for purposes otherwise deemed to be in the best interest of the Company. The timing of these equity award grants is not based on the timing of the release of material, non-public information, nor is such information released for the purpose of affecting the value of executive compensation.

| 16 |

Historically, the design of the annual cash incentive plan available for officers other than the CEO was intended to be primarily objective and formulaic. Each year, the committee established annual performance metrics relating to financial performance and strategic initiatives and annual incentive opportunities for management employees, including the Named Executive Officers. The annual incentive opportunities were determined as a percentage of the individual’s base salary. In addition, the committee retained discretion to adjust annual incentive awards, taking into account non-formulaic considerations such as the context in which certain performance achievement occurred, the unique experience an individual brings to a role, and other factors the committee deemed relevant.

The In recent years, the committee has decided not to establish a plan based on objective, offormulaic performance goals and metrics for the Company’s long-term incentive program is to directly align compensation outcomes with returns received by shareholders, build equity ownership within the management team,Company and motivate the sustainable financial performanceinstead determined that supports stock price growth. Long-termannual incentive awards are made pursuant to management, including the Company’s 2012 Stock Incentive Plan, which permits grants of cash awards, stock options, stock appreciation rights and stock awards. ThroughoutNamed Executive Officers other than the year, the committee may also approve awards in connection with employee promotions, employee retention, an individual newly hired to the Company, or for purposes otherwise deemed toCEO, would be in the best interest of the Company. The timing of these equity award grants is not based on the timing of the release of material, non-public information, nor is such information released for the purpose of affecting the value of executive compensation.discretionary.

The typical pay review process occurs at the beginning of the fiscal year at which time the Compensation Committee reviews and approves executive compensation, including adjustments in base salaries, annual incentive awards and equity awards, and, if appropriate, establishes performance goals and target incentive opportunities for the annual incentive plan for the following fiscal year. During the review process, the committee considers a number of factors, including competitive market data, input received from the Company’s management, an assessment of individual performance and the operating performance of the Company.

20202023 Executive Compensation

Annual Base Salary. The Compensation Committee decided to make no changes to the annual base salary during 20202023 for the Named Executive Officers, which remained at $60,000 per year for Mr. Fischel, our Chief Executive Officer, and $223,000 for Ms. Peery, which remained at $220,000 per year. Ms. Kimberly R. Peery was appointedour Chief Financial Officer effective October 1, 2019. Effective December 1, 2020, Mr. David Fischel receives an annual base salary of $60,000. Prior to that date, Mr. Fischel did not receive a base salary.Officer.

Annual Incentive Plan. The committee decided not to establish a 20202023 annual incentive plan based on objective, formulaic performance goals and metrics for the Company or the Named Executive Officers, and instead determined that annual incentive awards to management, including the Named Executive Officers, for the 20202023 fiscal year would be discretionary.

Long-Term Incentive Compensation. In March 2020,2023, a grant of service-vested Incentive Stock Options, vesting 25% on the first anniversary and 2.083% per month thereafter through the fourth anniversary, was made to Ms. Peery with the intention of emphasizing retention and the criticality of shareholder alignment during this key phase in the Company’s life-cycle. In February 2021, the Board, upon recommendation of the Compensation Committee and subject to shareholder approval, approved a grant of performance based restricted stock units to Mr. Fischel, with vesting contingent on achievement of minimum service requirements and market-based milestones. Shareholders subsequently approved the award in May 2021. As of December 31, 2023, none of the performance milestones established by the 2021 CEO Incentive Program have been achieved and no awards have been earned. The full award document can be found in Exhibit 10.5 to our 2023 Form 10-K filed with the SEC on March 8, 2024.

RecoupmentClawback Policies

In 2023, our Board adopted the Stereotaxis Incentive Compensation Recovery Policy (the “Dodd-Frank Clawback Policy”) to comply with final rules required by the Dodd-Frank Wall Street Reform and Consumer Protection Act and the SEC, and the applicable NYSE American listing standards. The Dodd-Frank Clawback Policy provides for the mandatory recoupment of erroneously awarded incentive-based compensation in the event of an accounting restatement. In such an event, the Company would seek to recover the amount of erroneously awarded incentive-based compensation paid to applicable covered executives that was in excess of the amount that would have been awarded based on the restated financial results, subject to and in accordance with the terms of the policy and applicable law.

The Compensation Committee has also adopted, separate from and in addition to the Dodd-Frank Clawback Policy, a recoupment policy applicable to incentive compensation based on financial results, including the annual bonus and equity-based compensation, to our Named Executive Officers and other executives. If we are required to file a restatement of financial results due to fraud, gross negligence or willful misconduct, then our independent directors may take action to recoup any portion of the incentive compensation awarded to the executives that exceeded the amount that would have been awarded based on the restated financial results during the three fiscal years prior to the filing of the restated financial results.

| 17 |

Other Benefits

| ● | Healthcare and Other Insurance Programs: All of our employees, including the Named Executive Officers, are eligible to participate in medical, dental, short and long-term disability and life insurance plans. The terms of such benefits for our Named Executive Officers are the same as those for all of our employees. | |

| ● | 401(k): We offer all eligible employees the opportunity to participate in a 401(k) plan. Employer matching contributions are discretionary under the 401(k) plan. During | |

| ● | Employee Stock Purchase Plan: The Company offers an employee stock purchase plan, under which all of our employees, including our Named Executive Officers, who do not own 5% or more of our outstanding common stock, have the opportunity to buy |

Compensation Risk Assessment

The Compensation Committee has considered potential risks arising out of our compensation programs and does not believe our compensation programs encourage excessive or inappropriate risk taking by our employees. The Compensation Committee believes that our compensation packages, which are structured to balance fixed and variable compensation and include both annual and long-term incentives, mitigates againstmitigate unnecessary or excessive risk taking.

The following table summarizes the total compensation paid to the following Named Executive Officers for fiscal years 20192022 and 2020.2023. For more information about the components of the total compensation, refer to the “Executive Compensation Summary and Analysis” section of this proxy statement.

| Name and Principal Position | Year | Salary ($) | Stock Awards ($) | Option Awards ($)(1) | Non-Equity Incentive Plan Compensation ($)(2) | All Other Compensation ($)(3) | Totals ($) | ||||||||||||||||||||

| David L. Fischel | 2023 | 60,000 | - | - | - | 2,195 | 62,195 | ||||||||||||||||||||

| Chief Executive Officer | 2022 | 60,000 | - | - | - | 2,195 | 62,195 | ||||||||||||||||||||

| Kimberly R. Peery | 2023 | 223,000 | - | 72,040 | 20,000 | 8,758 | 323,798 | ||||||||||||||||||||

| Chief Financial Officer | 2022 | 222,500 | - | 134,920 | 20,000 | 9,340 | 386,760 | ||||||||||||||||||||

| Name and Principal Position | Year | Salary ($) | Option Awards ($)(1) | Non-Equity Incentive Plan Compensation ($)(2) | All Other Compensation ($)(3) | Totals ($) | ||||||||||||||||||

| David L. Fischel | 2020 | 5,000 | - | - | 33 | 5,033 | ||||||||||||||||||

| Chief Executive Officer(4) | 2019 | - | - | - | - | - | ||||||||||||||||||

| Kimberly R. Peery | 2020 | 220,000 | 130,160 | 35,000 | 8,948 | 394,108 | ||||||||||||||||||

| Chief Financial Officer(5) | 2019 | 55,000 | - | 7,500 | 1,857 | 64,357 | ||||||||||||||||||

| (1) | Amounts reported reflect the aggregate grant date fair value of awards granted during the year computed in accordance with ASC 718, Compensation-Stock |

| (2) | These amounts represent cash awards earned during the respective fiscal year under the applicable annual incentive programs, irrespective of the year in which they were actually paid. |

| (3) | All Other Compensation includes the payment of group term life insurance premiums and employer match contributions to the executive’s 401(k) plan earned in the respective fiscal year. |

| 18 |

Outstanding Equity Awards at Fiscal Year-End

| Option Awards | Stock Awards | Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||||||||||||||

| Named Executive Officer | Date of Award | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable(1) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($)(2) | Date of Award | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable(1) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($)(2) | ||||||||||||||||||||||||||||||||||||

| 7/3/2017 | 30,000 | 152,700 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 1/2/2018 | 30,000 | 152,700 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 7/2/2018 | 30,000 | 152,700 | ||||||||||||||||||||||||||||||||||||||||||||||||

| David L. Fischel(3) | 1/2/2019 | 30,000 | 152,700 | 1/2/2019 | 30,000 | 52,500 | ||||||||||||||||||||||||||||||||||||||||||||

| 7/1/2019 | 30,000 | 152,700 | 7/1/2019 | 30,000 | 52,500 | |||||||||||||||||||||||||||||||||||||||||||||

| 1/2/2020 | 30,000 | 152,700 | 1/2/2020 | 30,000 | 52,500 | |||||||||||||||||||||||||||||||||||||||||||||

| 7/1/2020 | 30,000 | 152,700 | 7/1/2020 | 30,000 | 52,500 | |||||||||||||||||||||||||||||||||||||||||||||

| 1/4/2021 | 25,000 | 43,750 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 3/27/2014 | 4,000 | 4.04 | 3/27/2024 | 2/27/2021 | (4) | 13,000,000 | 22,750,000 | |||||||||||||||||||||||||||||||||||||||||||

| Kimberly R. Peery | 3/27/2014 | 4,000 | 4.04 | 3/27/2024 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2/26/2018 | 8,462 | 7,288 | 0.74 | 2/26/2028 | 2/26/2018 | 15,750 | 0.74 | 2/26/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Kimberly R. Peery(4) | 3/3/2019 | 15,320 | 19,680 | 2.03 | 3/3/2029 | |||||||||||||||||||||||||||||||||||||||||||||

| 3/9/2020 | 40,000 | 4.52 | 3/9/2030 | 3/3/2019 | 35,000 | 2.03 | 3/3/2029 | |||||||||||||||||||||||||||||||||||||||||||

| 3/9/2020 | 37,522 | 2,478 | 4.52 | 3/9/2030 | ||||||||||||||||||||||||||||||||||||||||||||||

| 3/8/2021 | 27,514 | 12,486 | 6.96 | 3/8/2031 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2/25/2022 | 18,340 | 21,660 | 4.80 | 2/25/2032 | ||||||||||||||||||||||||||||||||||||||||||||||

| 3/1/2023 | - | 40,000 | 2.57 | 3/1/2033 | ||||||||||||||||||||||||||||||||||||||||||||||

| (1) | The amounts appearing in this column represent the total number of options and stock appreciation rights (SARs) that have not vested as of December 31, | |

| (2) | Based on the closing price of | |

| (3) | ||

| (4) |

| 19 |

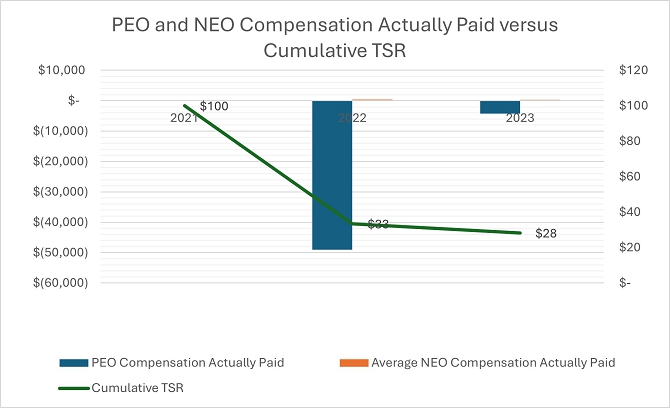

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation actually paid and certain financial performance of our company. The Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the fiscal years shown.

| Year | Summary Compensation Table Total for Principal Executive Officer (“PEO”) | Compensation Actually Paid to PEO(1) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers (“NEOs”) | Average Compensation Actually Paid to Non-PEO NEOs(1) | Value of Initial Fixed $100 Investment Based On Total Shareholder Return (“TSR”)(2) | Net Income (Loss)(3) (millions) | ||||||||||||||||||

| Year | Summary Compensation Table Total for Principal Executive Officer (“PEO”) | Compensation Actually Paid to PEO(1) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers (“NEOs”) | Average Compensation Actually Paid to Non-PEO NEOs(1) | Value of Initial Fixed $100 Investment Based On Total Shareholder Return (“TSR”)(2) | Net Income (Loss)(3) (millions) | ||||||||||||||||||

| 2023 | 62,195 | (4,286,114 | ) | 323,798 | 270,703 | 28.23 | (20.71 | ) | ||||||||||||||||

| 2022 | 62,195 | (49,087,719 | ) | 386,760 | 94,383 | 33.39 | (18.30 | ) | ||||||||||||||||

| (1) | Amounts represent compensation actually paid to our CEO, Mr. David Fischel, who was our Principal Executive Officer or “PEO” for each of the years shown, and the average compensation actually paid to our CFO, Ms. Peery, as our remaining NEO or “Non-PEO NEO” for the relevant fiscal year. Amounts were computed in accordance with Item 402(v) of Regulation S-K and do not reflect the actual amount of compensation earned by or paid to Mr. Fischel or Ms. Peery during the applicable year. |

| (2) | Cumulative TSR is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between our company’s share price at the end and the beginning of the measurement period by our company’s share price at the beginning of the measurement period. No dividends were paid on stock or option awards in 2022 or 2023. |

| (3) | The dollar amounts reported represent the amount of net income (loss) reflected in our consolidated audited financial statements for the applicable year. |

Amounts represent the Summary Compensation Table Total Compensation for the applicable fiscal year adjusted as follows:

| PEO | Average non-PEO NEOs | PEO | Average non-PEO NEOs | |||||||||||||

| 2022 | 2023 | |||||||||||||||

| PEO | Average non-PEO NEOs | PEO | Average non-PEO NEOs | |||||||||||||

| Deduction for ASC 718 Fair Value as of Grant Date Reported under the Stock Awards and Option Awards Columns in the Summary Compensation Table | - | (134,920 | ) | - | (72,040 | ) | ||||||||||

| Year End Fair Value of Outstanding and Unvested Equity Awards Granted in the Year | - | 46,680 | - | 42,880 | ||||||||||||

| Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year | - | - | - | - | ||||||||||||

| Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years | (49,149,914 | ) | (109,265 | ) | (4,348,309 | ) | (12,967 | ) | ||||||||